maryland local earned income tax credit

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Required to file a tax return.

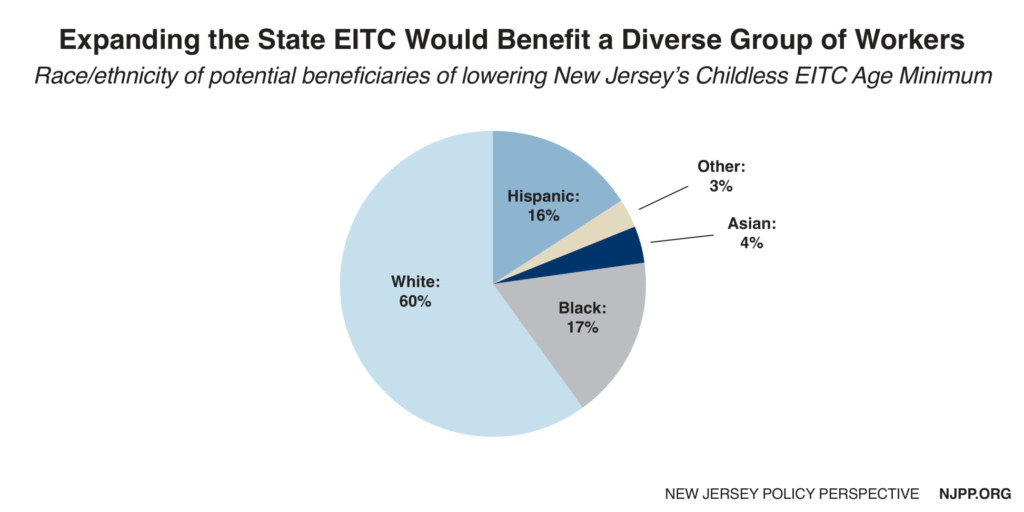

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers New Jersey Policy Perspective

The state EITC reduces the.

. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. Ii Primary Staff for This Report. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

CASH Campaign of Maryland 410-234-8008 Baltimore Metro. The maximum federal credit is 6728. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159.

The earned income tax credit is praised by both parties for lifting people out of poverty. SB 619 increases the value of Marylands Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes by increasing. Eligibility and credit amount depends on your income.

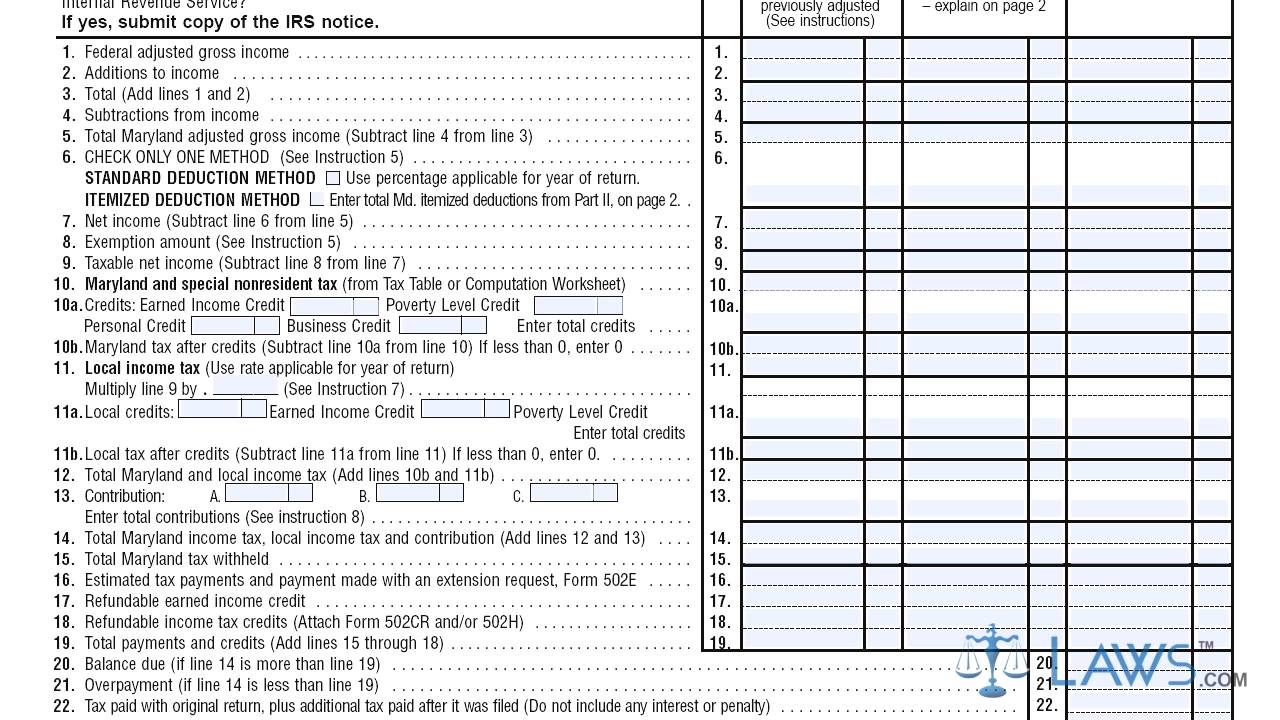

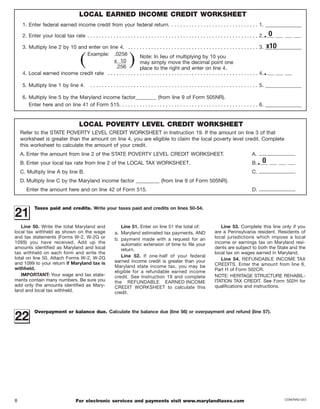

Average tax credits per tax return for these ZIP Codes range from a high of 3060 in Park Hall 20667 in Saint Marys County to a low of 2668 received in Southwest. Detailed EITC guidance for Tax Year 2021 including. A taxpayer can also claim a nonrefundable earned income credit against the local income tax.

EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. You must file taxes.

BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit. Ii Primary Staff for This Report. Detailed EITC guidance for Tax Year 2021 including.

About 86000 people in Maryland file tax returns without using a Social Security. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. Thestate EITCreducesthe amount of Maryland tax you owe.

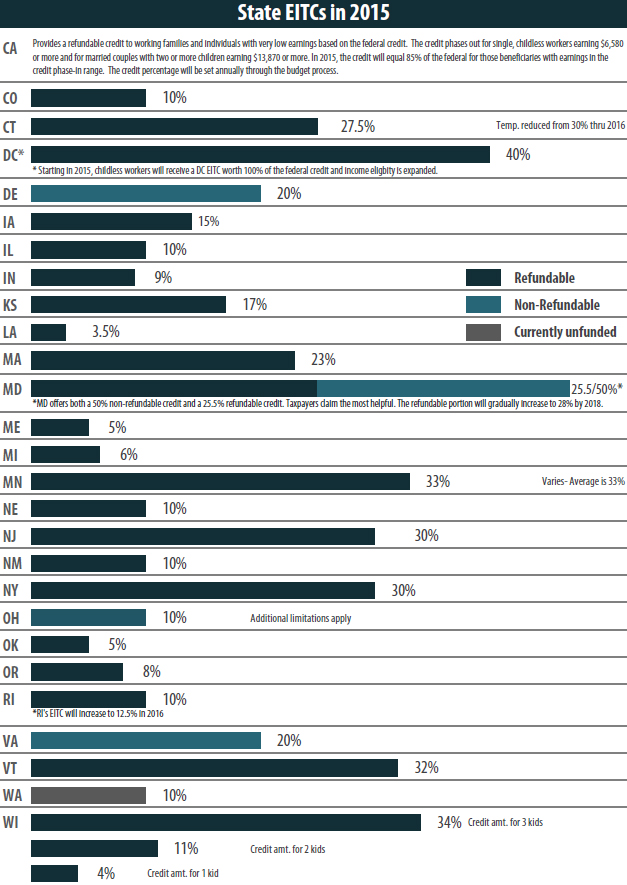

It is the nations most effective anti-poverty program. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the.

The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. Earned Income Tax Credit. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

The amount of the credit allowed against the local income tax is equal to the federal credit. See Worksheet 18A1 to calculate any refundable earned income tax credit. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

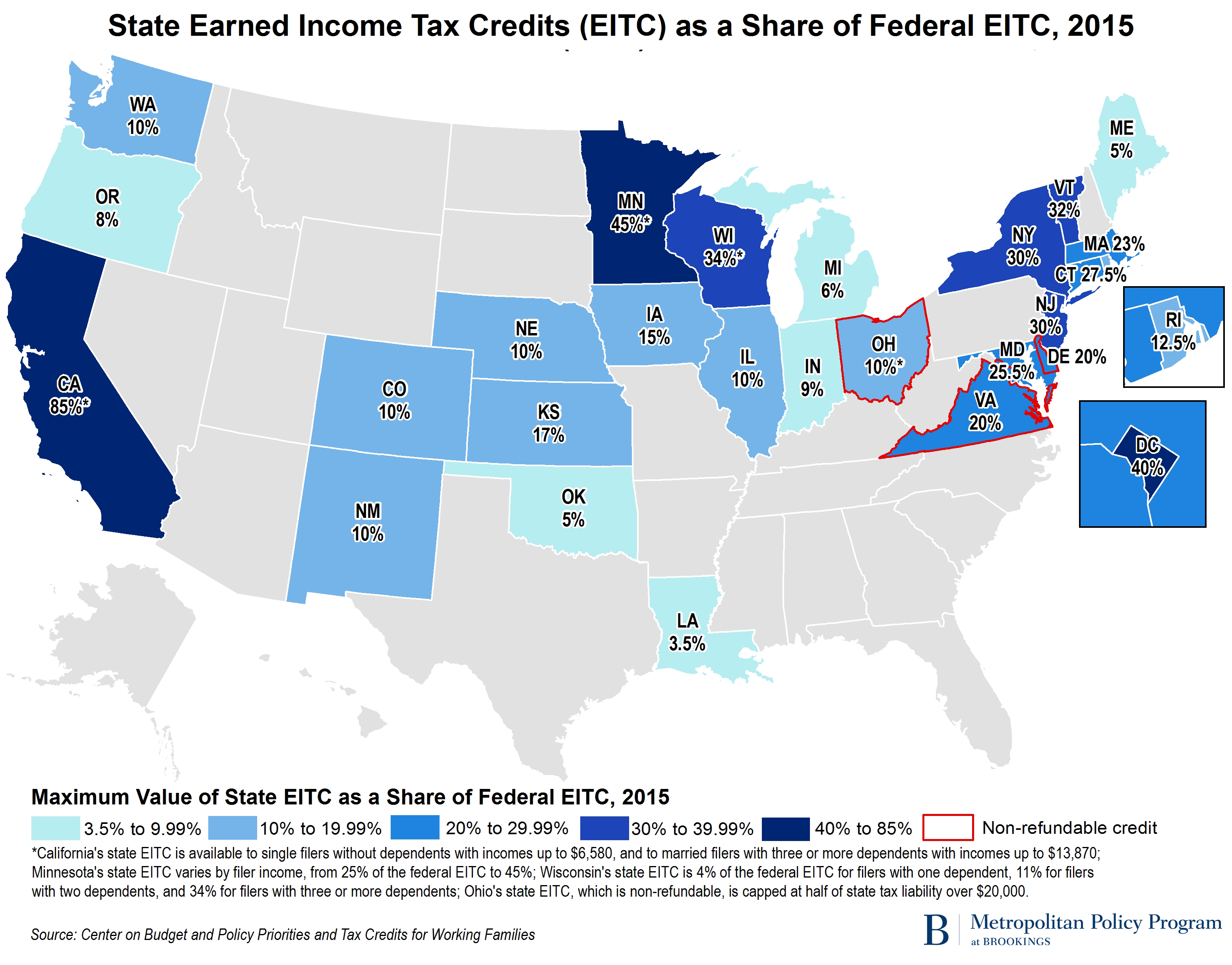

36 rows States and Local Governments with Earned Income Tax Credit More In.

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Earned Income Tax Credit Changes H R Block

Tax Credits Deductions And Subtractions

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

State Policy And Practice Related To Earned Income Tax Credits May Affect Receipt Among Hispanic Families With Children Child Trends

States Adopt And Adapt The Eitc To Address Local Need

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Form 502x Amended Maryland Tax Return Youtube

Symons Accounting Westernport Md Facebook

Rewarding Work Through State Earned Income Tax Credits Itep

Maryland Paycheck Calculator Smartasset

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

Earned Income Tax Credit Now Available To Seniors Without Dependents

Local Income Taxes In 2019 Local Income Tax City County Level

W 2 Form For Wages And Salaries For A Tax Year By Jan 31